In the intricate web of global finance, where the value of a currency can sway with the slightest economic breeze, the foreign exchange market stands as a barometer of a nation’s economic health. As the largest and most bustling financial market in existence, the forex market sees a staggering $6.6 trillion in transactions daily, a ceaseless dance of currencies from every corner of the globe.

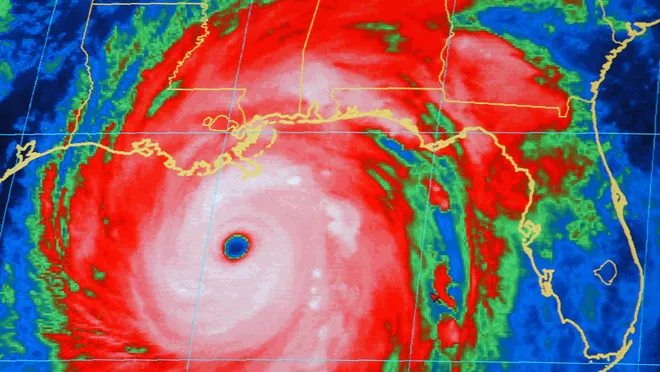

Yet, amidst the steady rhythm of trading, there are moments of discord that echo far beyond the trading floors and digital screens. Hurricanes, earthquakes, floods, wildfires, and typhoons- nature’s unforgiving hand – strikes with a force that reverberates through economies and currencies alike. These catastrophic events bring not only physical devastation, but also a profound disruption to the delicate machinery of commerce.

In the wake of such disasters, businesses shutter, infrastructure lies shattered, and supply chains falter, leaving a mark on asset prices. The forex market, with its keen sensitivity to global events, bears witness to the ripple effects of these tragedies, as exchange rates fluctuate in response to the turmoil. Yet, amidst the volatility, there exists a complex interplay of forces, where the impact of natural disasters on currency values unfolds in a mosaic of economic consequences.

Nature’s Impact on Currency

Picture a coastal town under siege by an impending storm. Clouds gather ominously as waves crash with unsettling force. Suddenly, chaos strikes. Buildings crumble, roads twist, and economic activity halts. Stock prices plummet, investor confidence wavers.

But the aftermath extends beyond the visible wreckage. Supply chains fracture, shelves empty, and insurance costs soar. Governments rush to respond, but debt and inflation loom. Across borders, the storm’s impact disrupts global commerce. Amidst the turmoil, the forex market reflects the broader economic fallout of nature’s fury.

The impact of a natural disaster on the currency market is tied closely to the region’s overall economy. Timing is critical: a disaster striking during a period of robust economic growth may find the economy more resilient, better equipped to absorb the shockwaves. However, when nature’s wrath descends upon a nation already grappling with economic downturn, the consequences can be far more profound, destabilizing currency values further.

Yet, amidst the wreckage lies the potential for renewal. The process of reconstruction and recovery often unfolds, ushering in what economist term as the “reconstruction boom.” This phase sees a surge in demand across various sectors as communities rebuild shattered infrastructure and homes. This increased demand can drive economic activity and investment, supporting the national currency in the medium term.

Thus, while natural disasters may initially unleash chaos and uncertainty in the currency market, they also set in motion a complex interplay of economic forces, where the path to recovery offers both challenges and opportunities for currency values to evolve.

Navigating the Storm

It’s in these moments of crisis that the true power of the forex market reveals itself. As businesses falter and nations reel, investors scramble to recalibrate their positions, seeking refuge in safe-haven currencies or seizing opportunities amid the chaos. The impact is profound and immediate, as exchange rates fluctuate wildly and fortunes hang in the balance.

Natural disasters have left an inerasable mark on the financial markets throughout history, serving as stark reminders of the vulnerability of economies to nature’s wrath. Here are some poignant examples that underscore the profound impact of natural calamities on the stock market:

Japan’s 2011 Tsunami: Nikkei Plummets

On March 11, 2011, a catastrophic 9.1 magnitude earthquake struck off the coast of Japan’s Tohoku region, triggering a devastating tsunami. The aftermath was grim, with widespread destruction and loss of life. The financial repercussions were also significant, with Japan’s benchmark stock index, the Nikkei, plummeting by a staggering 7.5% in the days following the disaster. Investor confidence was shaken as uncertainty loomed over the nation’s recovery efforts.

Hurricane Katrina (2005): Economic

Devastation

Hurricane Katrina stands as one of the costliest natural disasters in U.S. history, wreaking havoc on New Orleans and the Gulf Coast region. With reported losses soaring as high as $125 billion, the hurricane left a trail of destruction in its wake. The stock market felt the impact as well, experiencing a decline amid the chaos. Furthermore, the depreciation of the U.S. dollar added to the economic strain caused by the disaster, exacerbating the financial fallout.

The Indian Ocean Tsunami (2004): A Tragic Toll on Economies

The Indian Ocean Tsunami of 2004 stands as one of the deadliest natural disasters in recorded history, ravaging coastal communities across Indonesia, Sri Lanka, and Thailand. The economic toll was staggering, with estimated damage costs reaching $9.4 billion. Beyond the immediate human tragedy, the tsunami had a profound negative impact on the national economies of the affected countries. The stock markets grappled with uncertainty as investors assessed the long-term repercussions of the disaster on key industries and infrastructure

Forex Trading Amidst Natural Disasters with Magna Financial’s Forward Deals

Magna Financial stands as your reliable partner, offering essential services to trade currencies safely and efficiently. Our expertise in Forward Deals enables you to secure tomorrow’s currency at today’s rate, shielding you from potential volatility caused by unforeseen events. With real-time market analysis and insights, we keep you informed about the impact of disasters on currency pairs, empowering you to make well-informed decisions. Our risk management strategies help safeguard your investments, while access to alternative trading instruments provides additional hedging opportunities. With swift execution services and dedicated customer support, we ensure you can navigate market turmoil with confidence and peace of mind.

For all your currency requirements, we are here to provide expert assistance and personalized guidance. Whether you need assistance with currency exchange, international money transfers, or managing fluctuations in exchange rates, our team has you covered. Feel free to reach out to us directly for any currency-related inquiries or financial advice. Your seamless transition is our priority, and we are committed to making it a smooth and stress-free experience for you.

Contact us at: +44 (0) 203 371 9966 | info@magnafinancial.com